22/05/2024

Textile market in April and economic outlook in 2024

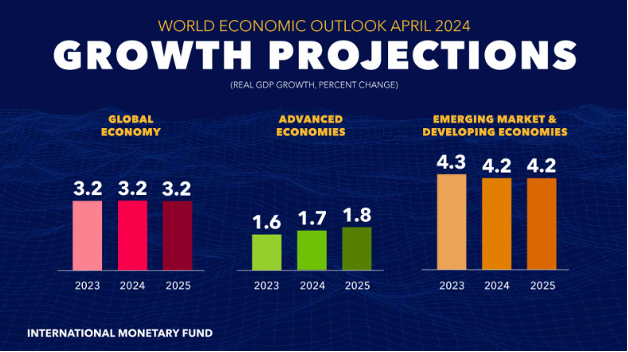

In 2024, according to the IMF’s April 2024 report, the world economy in April is forecasted to be better than January 2024 report, world economic growth is forecasted to recover at 3.2%, an increase of 0.1% compared to the January 2024 forecast however it remains lower than the average growth rate before the Covid epidemic at 3.8%. The domestic economic economy is also better recover than in 2023 with the country’s general export turnover of goods in the first 4 months of 2024 reaching 123.6 billion USD, increased 15% over the same period. Vietnam’s textile and garment exports also recovers according to market trends when export turnover reached 12.5 billion USD after the first 4 months of the year, increased 7.5% over the same period. However, risks remain to the market as geopolitical tensions continue, including those from the conflicts in Ukraine-Russia and in the Gaza Strip, along with persistent underlying inflation, the labor market remains tight, possibly reducing expectations for interest rate cuts in major economic markets.

Global trade and GDP growth forecast

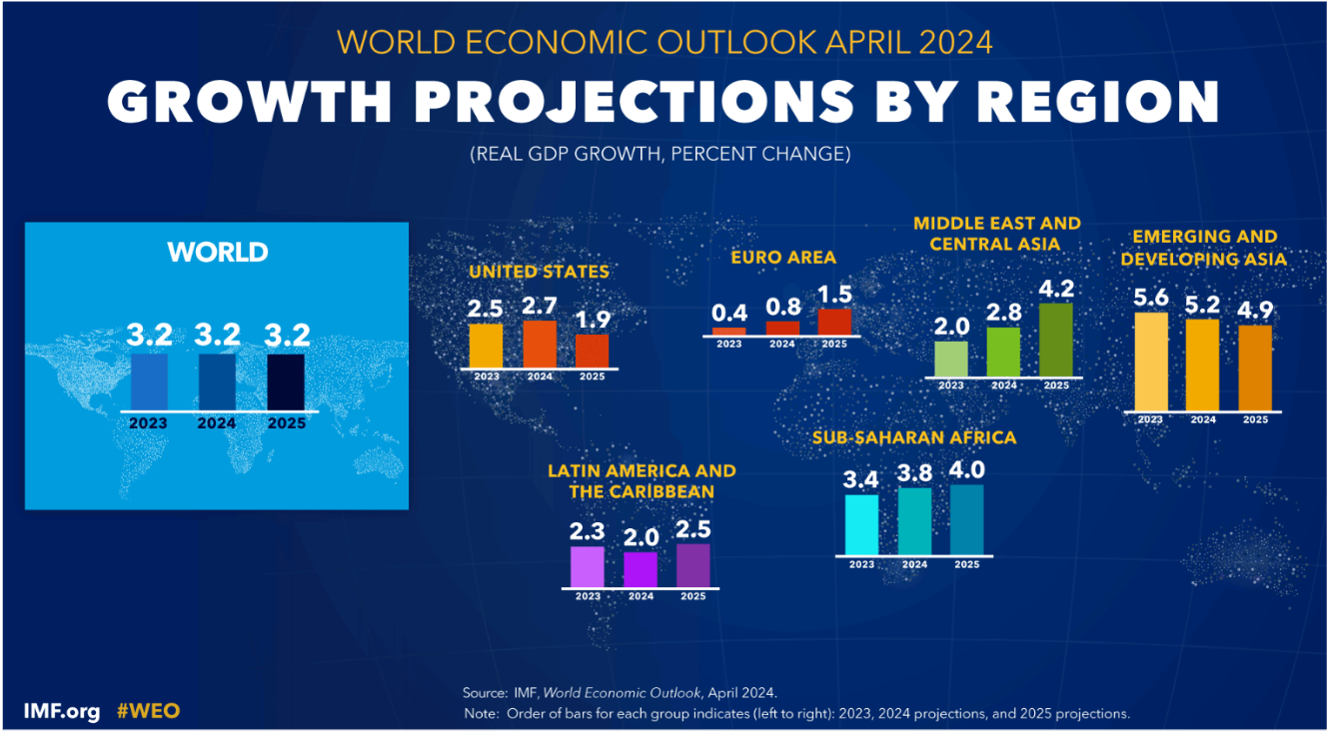

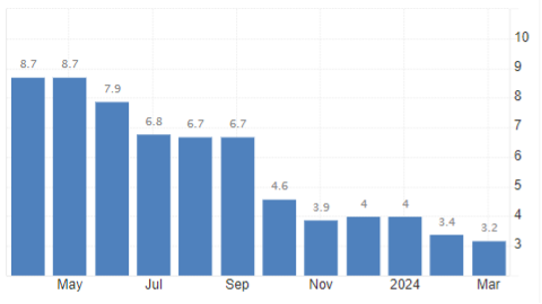

According to the IMF report on April 16, global GDP growth is forecasted at 3.2% in 2024 and 2025 (0.1% higher than the January 2024 report). The global economic forecast in April 2024, although assessed at a slow level, is more resilient and more stable than at the beginning of the year. It is expected that global economic growth in 2024 and 2025 will be higher than 2019 at pre-pandemic levels but remains lower than the average pre-Covid growth rate of 3.8%. Global inflation is expected to fall from an annual average of 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025, with developed economies recovering return to inflation targeting earlier than emerging and developing economies.

US economy is forecasted to grow at 2.7% GDP in 2024 (while January 2024 report is forecasted at only 2.1%). In emerging and developing Asia, the GDP growth forecast is unchanged from the January 2024 forecast, at 5.2% in 2024, however the growth forecast is expected to increase by 0.1% in 2025 compared to previous forecasts in this area.

On the other hand, in the European region, growth forecast in April 2024 is only 0.8% in 2024, down 0.1% compared to the previous forecast (while January 2024 is forecasted to increase growth at 0.9%). Factors such as the ongoing Russia-Ukraine conflict caused the IMF to downgrade its growth forecast in the old continent.

US Economy

On May 1, 2024, FED kept the federal funds rate unchanged at its highest level in 23 years at 5.25% -5.5% for the sixth consecutive meeting and maintained this level since July 2023. After the recent meeting, FED is expected to cut the rate by three-quarters of a point by the end of this year. However, this is becoming less certain when inflation in the US in March 2024 is at 3.5% (the highest level since September last year). According to the IMF, persistent inflation will be the main reason why the FED will keep interest rates unchanged in the near future.

Meanwhile, according to the IMF’s April 2024 report, US GDP growth is expected to be higher in 2024 at 2.7% (0.6% higher than the IMF’s January 2024 forecast). The inflation in March 2024 in the US was at 3.5%, the highest since September last year but remain lower than the US annual average of 3.8%.

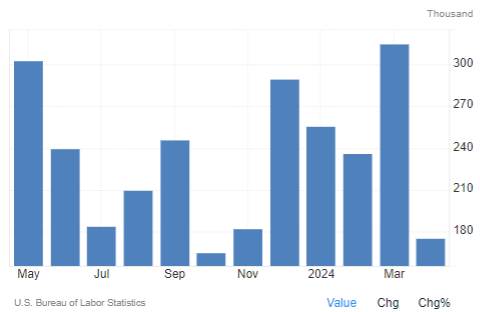

New US non-farm payroll jobs in April 2024 increased by 175 thousand jobs. This is the lowest employment increase since October 2023 (at 165 thousand), while March 2024 was at 315 thousand jobs. The jobs figure reflects a significant slowdown from the rapid pace of growth seen in the first quarter of 2024 and lags behind the average monthly gain of 242,000 U.S. jobs over the previous 12 months.

Europe Area economy

On April 11, 2024, the ECB decided to keep interest rates unchanged for the 5th consecutive time. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 4.50%, 4.75% and 4.00% respectively. GDP in the first quarter of 2024 in Europe increased by 0.3%, this is the highest growth since the third quarter of 2022 and is the first quarter after two consecutive quarters of no growth. Euro area inflation in April 2024 was at 2.4%. ECB policymakers Philip Lane, Gediminas Simkus and Boris Vujcic said the latest growth and inflation data alone reinforced confidence inflation would return to the central bank’s 2% target by mid-2024. According to CNBC, prices in the currency market currently show that the probability of the ECB cutting interest rates in June 2024 is approximately 70%.

UK economy

On May 9 2024, the BOE continued to keep interest rates at 5.25% for the 6th consecutive time to continue lowering inflation to the target level of 2%.

On May 2, the OECD released new forecasts for the world economy in which the OECD forecasts UK GDP to grow by 0.4% in 2024 and 1.0% in 2025 (lower than forecast) previously at 0.5. In March 2024, the UK inflation rate fell to 3.2% (from 3.4% in the previous month) but remained slightly above market expectations of 3.1%. This is the lowest inflation rate since September 2021, mainly due to slowing food inflation. Financial markets have predicted two interest rate cuts this year, with the first expected in August.

China economy

China’s gross domestic product (GDP) in the first quarter of 2024 increased by 5.3% over the same period, exceeding the market forecast of 5.0% and continuing the growth of 5.2% in Q4.23. China’s GDP growth target is expected to be 5% in 2024. Although manufacturing in China continues to grow, to maintain growth momentum, according to the IMF, China needs to have a comprehensive response to the struggling real estate sector to maintain growth and while reducing damage to trading partners.

Japan economy

On April 26, 2024, the BOJ kept interest rates around zero. The annual inflation rate in Japan fell to 2.7% in March 2024 from its peak in 2024, at 2.8% in February, in line with market expectations. Core inflation is forecasted to reach 2.8% in April, before falling to 1.9% in fiscal 2025 and 2026. BOJ Governor Kazuo Ueda said the central bank will raise interest rates if inflation growth exceeded forecast. Growth in Japan will recover steadily, with domestic demand underpinned by stronger real wage growth, continued accommodative monetary policy and temporary tax cuts. The GDP is expected to grow 0.5% in 2024 and 1.1% in 2025.

RETAIL SALES, APPAREL SPENDING IN THE US

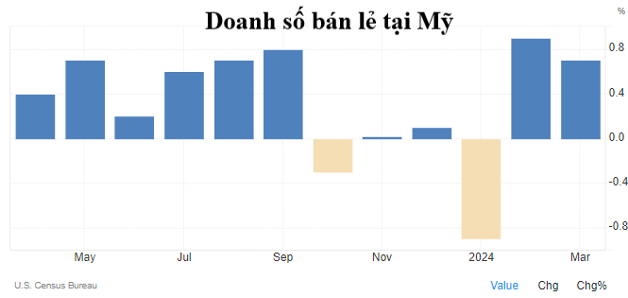

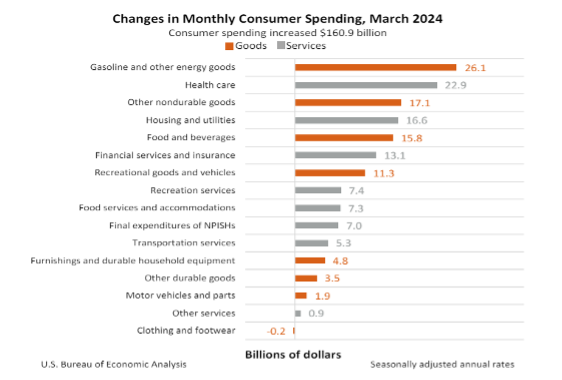

In March 2024 retail sales in the US increased 0.7% over the same period, following an upwardly revised 0.9% increase in February 2024 and much higher than forecast at 0.3%, including sales at non-store retailers (2.7%), gas stations (2.1%). On the other hand, sales fell for sporting goods, conveniences, musical instruments and bookstores (-1.8%), and clothing (-1.6%).

Vietnam’s textile and garment and other countries’s export turnover

Vietnam’s textile and garment export turnover

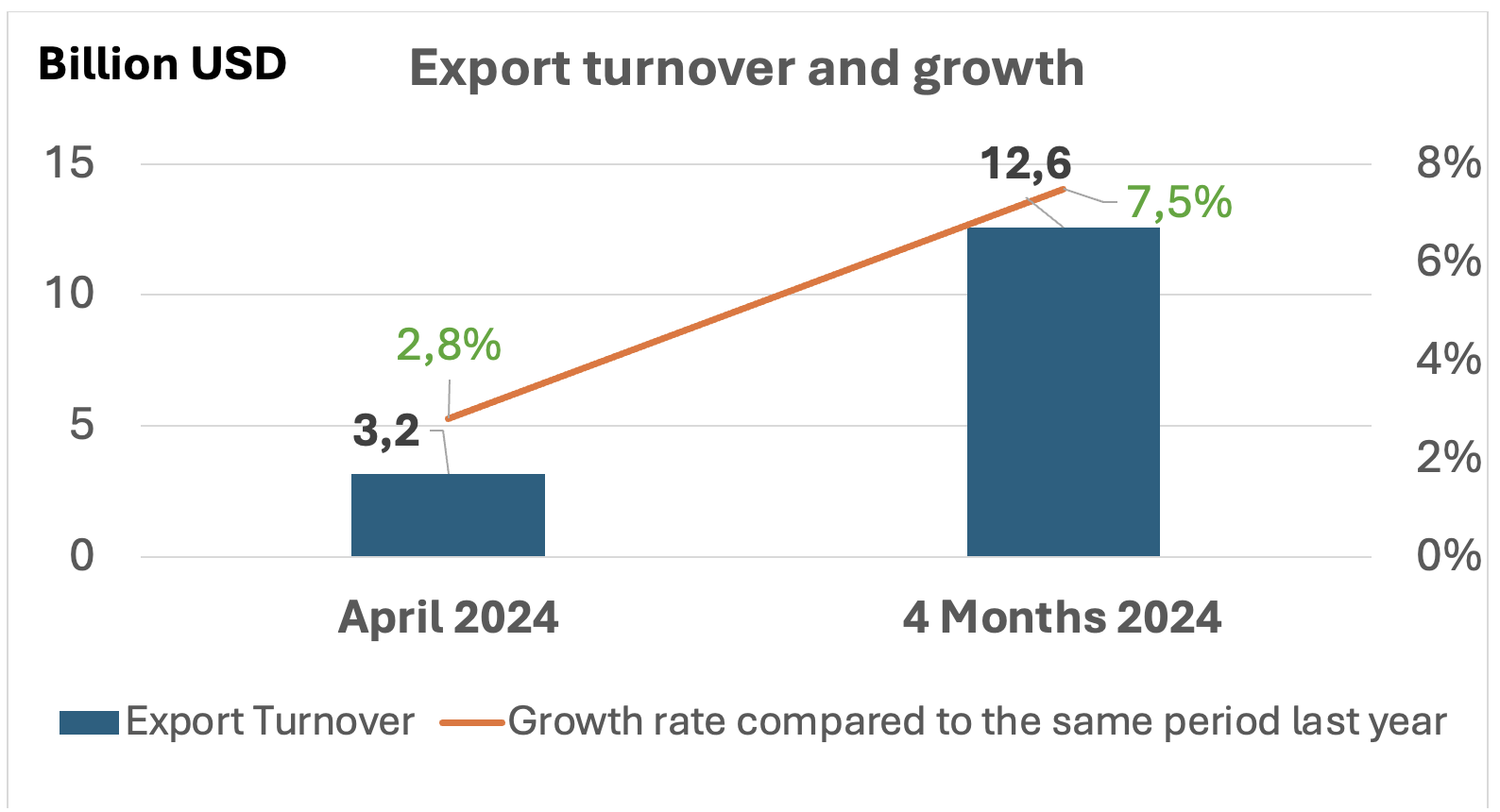

In April 2024, Vietnam’s textile and garment export turnover reached 3.15 billion USD, up 2.8% over the same period last year. Accumulated in the first 4 months of 2024, Vietnam’s textile and garment exports reached 12.5 billion USD, up 7.5% over the same period. In April 2024, Vietnam’s textile and garment export turnover continued to increase, marking the 5th consecutive month of growth since December 2023

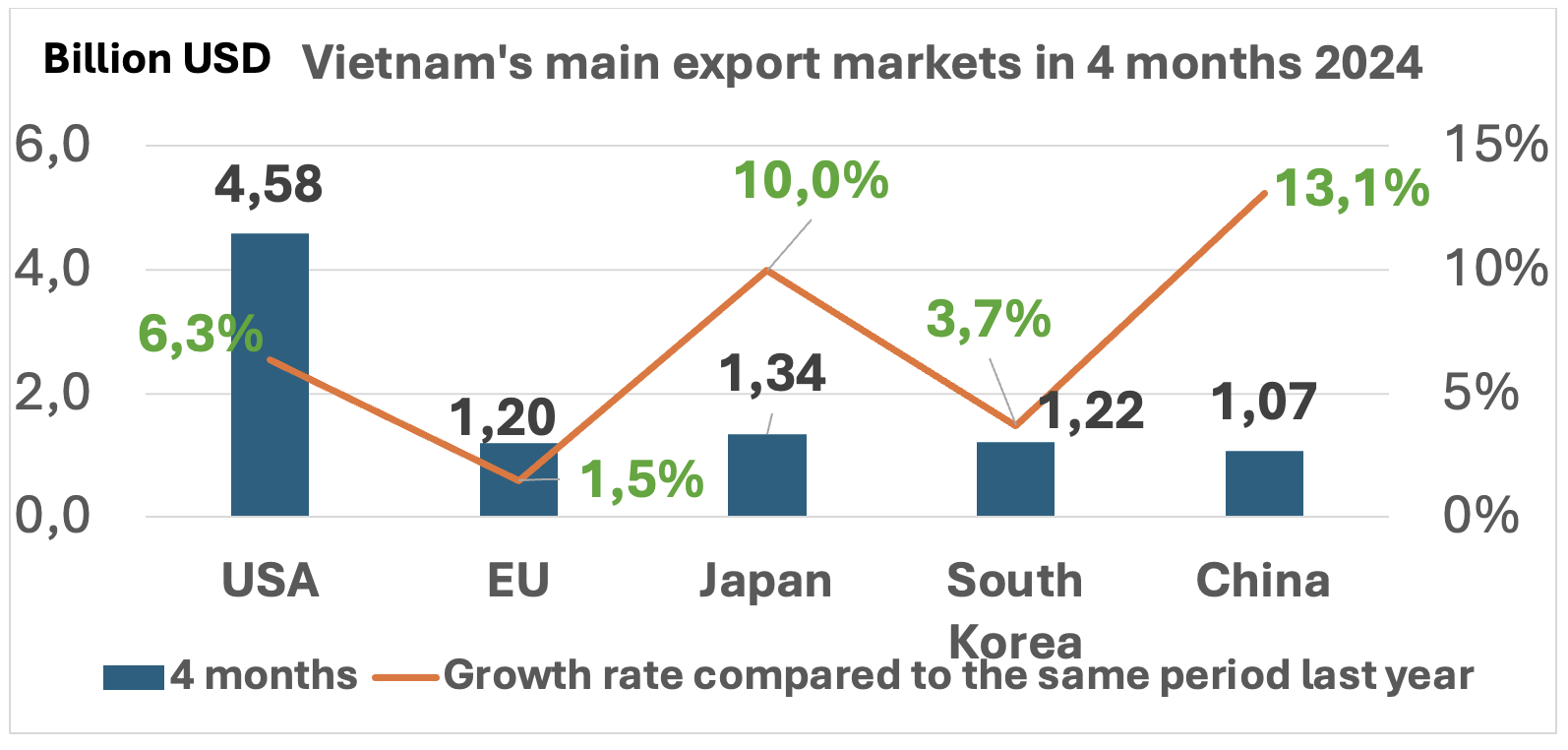

Vietnam’s main export markets

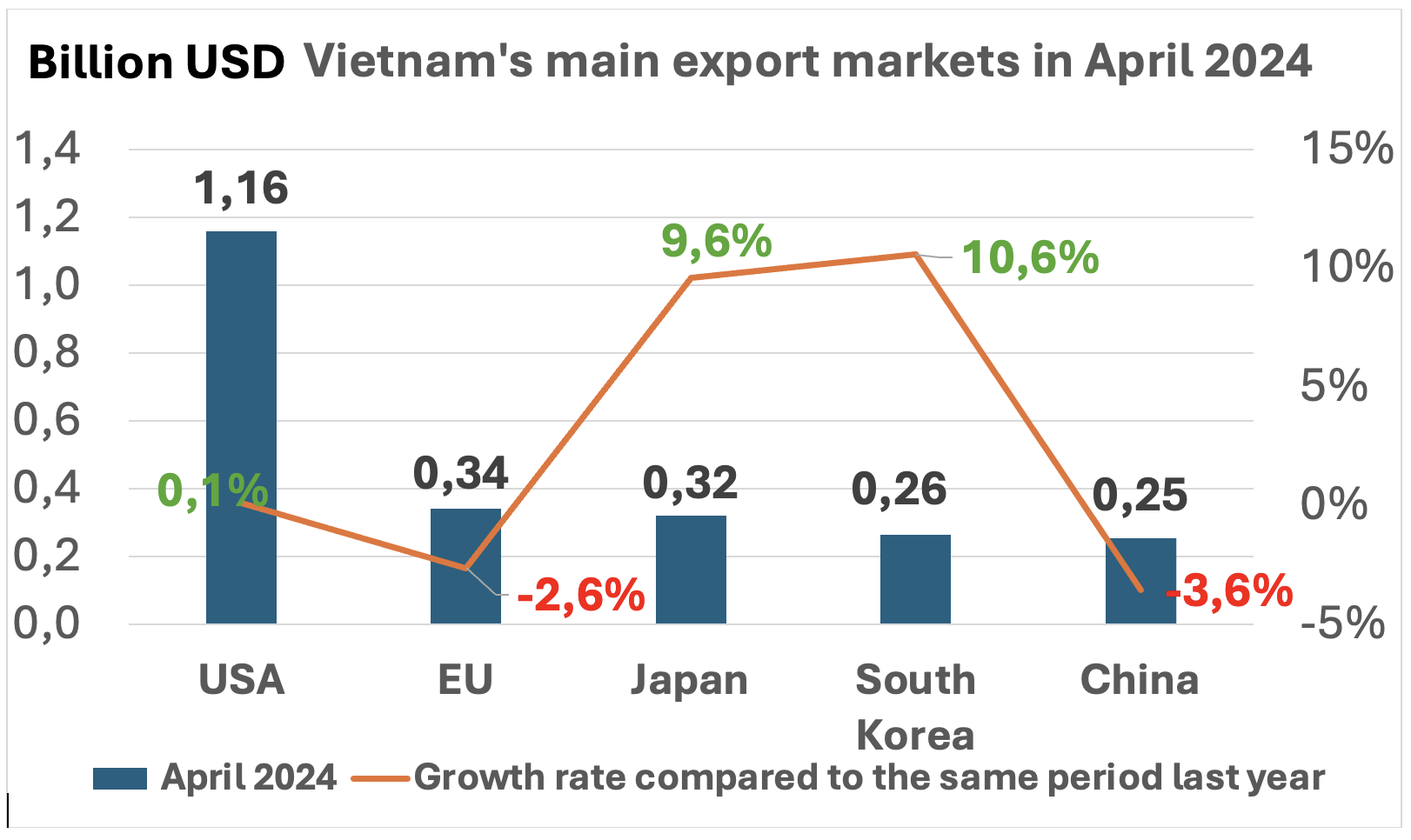

In April 2024: Vietnam’s textile and garment export turnover to the US reached 1.16 billion USD, up 0.1% over the same period, to Japan reached 319 million USD, up 9.6% over the same period, to South Korea reached 262 million USD, an increase of 10.6% over the same period. However, exports to the EU and China markets decreased in April. Export turnover to the EU reached 339 million USD, down 2.64% over the same period, to China reached 253 million USD, down 3.6% over the same period.

Accumulated 4 months in 2024: All major export markets of Vietnam are growing decent. Export turnover to the US reached 4.58 billion USD, up 6.3% over the same period, to the EU reached 1.2 billion USD, up 1.5% over the same period, to Japan reached 1.34 billion USD increased by 10% over the same period, to Korea reached 1.22 billion USD, increased by 3.7% over the same period, to China reached 1.07 billion USD, increased by 13.1% over the same period.

EXPORT TURNOVER OF MAJOR TEXTILE AND GARMENT EXPORTING COUNTRIES

China

In March 2024: China textile and garment export turnover reached 20.8 billion USD, down 21.1% over the same period, of which:

- Textile goods reached 10.3 billion, down 19.5% over the same period

- Garments reached 10.4 billion, down 22.6% over the same period

March 2024 is the month when China’s textile and garment export turnover dropped the deepest since April 2023. Cumulative first quarter in 2024: China textile and garment export turnover reached 65.9 billion USD, down 2% compared over the same period, of which:

- Textile products reached 32 billion USD, up 0.1% over the same period

- Garments reached 33.8 billion USD, down 3.8% over the same period

Bangladesh

April 2024: April is the first month in 2024 that Bangladesh’s textile and garment export turnover decreased. Total garment and textile export turnover reached 3.5 billion USD, down 1.4% over the same period. Garment export turnover reached 3.29 billion USD, down 1% over the same period, of which:

- Knitted goods reached 1.86 billion USD, up 2% over the same period

- Woven goods reached 1.42 billion USD, down 4.7% over the same period

Cumulatively in the first 4 months of 2024, Bangladesh’s total textile and garment export turnover reached 18.1 billion USD, an increase of 9.2% over the same period. Garment export turnover reached 17.1 billion USD, up 9.8% over the same period, of which:

- Knitted goods reached 9.3 billion USD, up 13.1% over the same period

- Woven goods reached 7.7 billion USD, an increase of 5.9% compared to the same period

Economic outlook in 2024

Global economic growth is forecasted at 3.2% in 2024 and 2025. Global inflation is expected to decline from an annual average of 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025, with advanced economies returning to inflation targets sooner than emerging and developing economies.

The IMF stated that the unexpected economic recovery, despite significant central bank interest rate hikes aimed at restoring price stability, also reflects the ability of households in major advanced economies can draw on significant savings accumulated during the pandemic. The Asia and Pacific region is considered to have modest growth at 4.5% (up 0.3 percentage points compared to last October’s forecast) and is the most dynamic region in the world, contributing about 60% of global growth. Among Asian countries, the IMF forecasts Vietnam’s GDP growth at 5.8% in 2024 and 6.5% in 2025.

In Vietnam, the economy shows signs of recovery following world trends with the country’s overall export turnover in the first 4 months of 2024 reaching 123.6 billion USD, up 15% over the same period, of which Vietnam’s textile and garment export turnover is 4 months reached 12.5 billion USD, up 7.5% over the same period. Although the economy is growing well, in that context there are still many potential risks when factors such as geo-political conflicts persist, in addition to the emergence of new conflict areas that disrupt the economy and global supply chain segment. Inflation in the US economy remains at a high level, accordingly, the reduction of policy interest rates is slower than expected, some US fashion brands are facing financial difficulties, leading to slow payments. Challenging factors still exist, requiring businesses to always be cautious and ready to respond to all difficult market conditions.

Share: